Business payments made easy

TRANSFER FOR BUSINESS

Business payments made easy

Streamline your business payments with our super-app platform, Pulse and a manager exclusively assigned to your account. Completely without charge.

Sending from

THE BUSINESS PLATFORM

Designed with SMEs in mind, Pulse includes an interactive dashboard, live currency rates, and a bulk upload feature for you to pay multiple stakeholders in one go.

We manage your business payments for free

With MoneyMatch, there are no registration or subscription charges. Only pay your small transfer fees!

Get started in minutes

Set up your account and start transacting instantly upon approval. Manage it all from your fingertips.

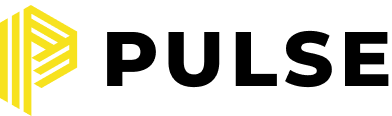

Save money on transfers

With our bank-beating rates and no hidden fees, stay in control of your spend and make your money go further.

Built for scale

Scale up your business globally. Leverage our features designed for SMEs and outsmart your competitors.

Pay overseas suppliers without hassle

Make payments to suppliers, vendors and remote employees in over 110 countries from the comfort of your office desk.

Learn more

Flat-fee, full transparency

Increase your profit margin with our bank-beating rates and low transfer fees shown upfront.

Efficient and timely delivery

Create orders, make payments and track your transfers smoothly with Pulse.

Simplify recurring payments

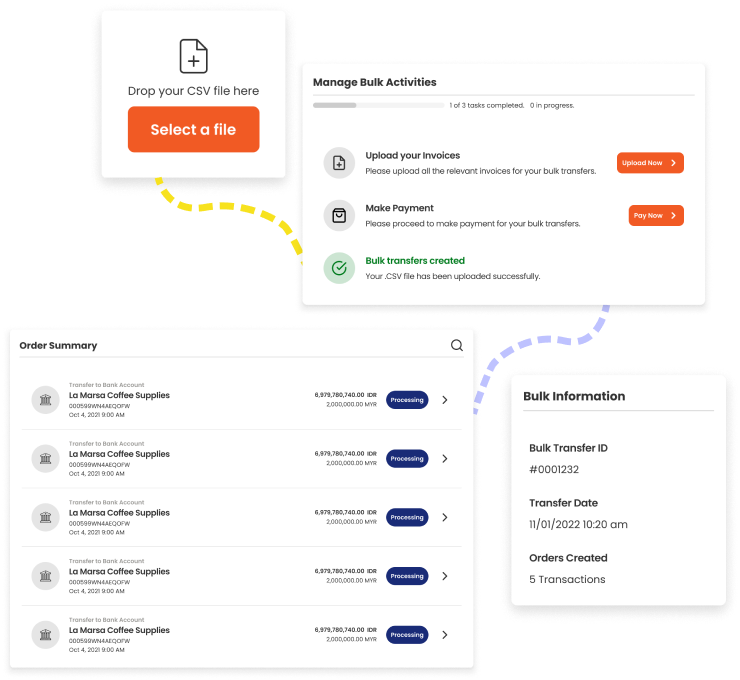

Maximize productivity and avoid the redundancy of making payments to multiple recipients with the bulk transfer feature on Pulse.

Upload bulk transfers

Pay up to 500 recipients in one go by grouping transfers of the same currency or destination country.

Streamline payments

Save significant time on international payroll, employee reimbursements, or recurring payments.

USER EXPERIENCE AND INTERFACE

Multilingual navigation and support

Switch to your preferred language between English, Bahasa Malaysia, and 中文 for a personalized experience while using Pulse!

SECURITY AND COMPLIANCE

Data protection and security prioritized

We operate within all regulatory and industry frameworks. A software is only as good as its security so we make it a priority to ensure our customers reliable and secure transactions from end-to-end.

Learn more

COVERAGE

Pay stakeholders in 88+ currencies and 110+ countries

Pay the world at the tip of your fingers.

Transfer now

Your B2B payment solution

Take control of your payments and finances with MoneyMatch.

MADE FOR SME

Transfer

Send money to stakeholders located around the globe without any subscription or hidden fees!

PROTECT YOUR ASSETS

Insurance

Protect your business assets with customized plans, covering from employee benefits to assets and liabilities.

SME Insurance

SCALE YOUR BUSINESS

Financing

Get paired with the best financing providers. Prioritize funding on efforts most crucial for your business’ growth.

CUSTOMER STORIES

Hear what our customers from various industries have to say

Frequently Asked Questions

Find out the most common questions asked on how to send money abroad with MoneyMatch.

Are there limits to how much I can transfer?

Yes. There are minimum and maximum limits for how much you can transfer using MoneyMatch. They depend on what currency you are sending, to whom you are sending to (an individual or a business), and which country you are sending to. You can check our limits in the Transaction Limits article. We will also inform you when you are setting up the transfer.

How long will my transfer take?

Once we have received your funds and all Compliance requirements are satisfied, it typically takes 1-2 working days to reach the recipient. The time it takes depends on the currencies involved, bank holidays and weekends in both the sending and receiving countries. Please note that we can only send or receive your money during regular banking hours.

Do I need to verify my business account before I can start using MoneyMatch?

As a regulated Financial Technology company, we are required to verify the identity of the person or entity that is transferring the money. After you have registered for a Business account and completed your profile, a MoneyMatch representative will contact you to schedule a visit to your office for the offline verification process. Learn more by taking a look at our Sign Up and Verification articles.

Do I need to provide supporting documents for my transfer?

When you create your transaction, you may be prompted to provide documents to support your order. Generally, we may request for documents to support your purpose of transfer (e.g. invoices for the purchase of goods and services; or a payslip for the payment of salary). Read our article on Types of supporting documents required for more information.

CUSTOMER SUPPORT

We are here for you

Our customer support team is ready to help ensure your transfers run smoothly.

Relationship manager

Get personalized support from an assigned Relationship Manager once you open a business account with us.

Take your business to the next level.

MoneyMatch Sdn.Bhd. 2026.All rights reserved.

MoneyMatch Sdn. Bhd (Co. Reg. No 201501008276 (1133611-P)) is regulated by Central Bank (licensee providing digital services) under MY Licence Serial Number 00544 in Malaysia.

Perniagaan Perkhidmatan Wang Berlesen | Pengirim Wang